44 ytm for coupon bond

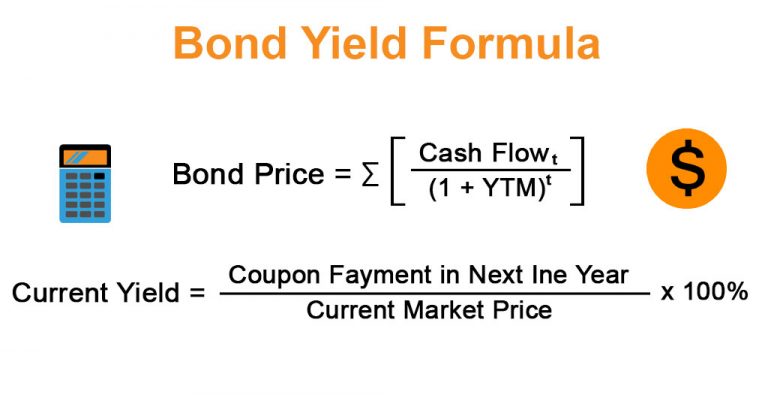

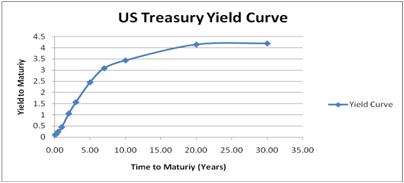

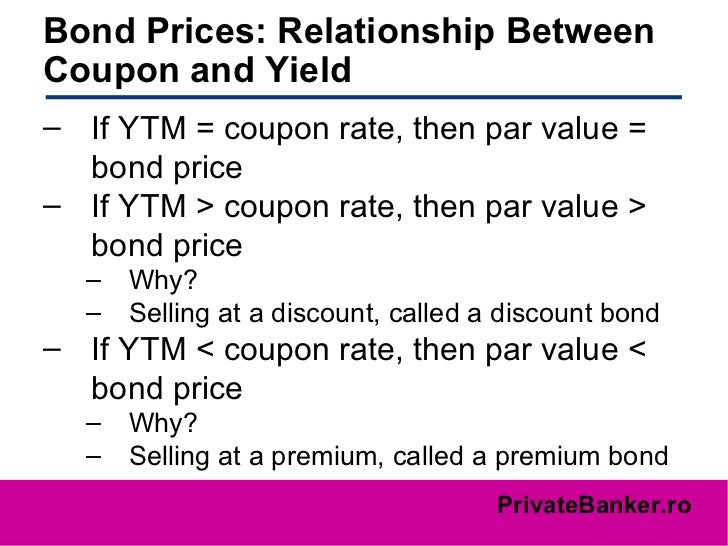

Yield to Maturity (YTM) Calculator YTM is beneficial to the bond buyer because a rising yield would decrease the bond price hence the same amount of interest is paid but for less money. Where the coupon payment refers to the total interest per year on a bond. Yield to maturity can be mathematically derived and calculated from the formula. Yield to Maturity (YTM) - Groww Here YTM will be higher than the coupon rate, which is 8%. If the bond is selling for a higher price than the face value, this means the interest rate in the market is lower than the coupon rate. This indicates that the YTM is lesser than the coupon rate. Current Yield. YTM is one of the ways that a bond yield can be represented and is useful ...

Understanding Coupon Rate and Yield to Maturity of Bonds When bonds are initially issued in the primary market, the Coupon Rate is based on current market rates, hence YTM is equal to the coupon rate. In the example bond above, when you bought the 3-year RTB issued at the primary market, your YTM and coupon rate is 2.375%. Now, what if you bought the security in the secondary market?

Ytm for coupon bond

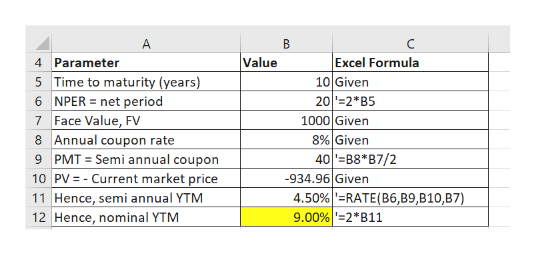

Yield to Maturity - Study Finance Yield to maturity (YTM) is the total expected return from a bond when it is held until maturity - including all interest, coupon payments, and premium or discount adjustments. The YTM formula is used to calculate the bond's yield in terms of its current market price and looks at the effective yield of a bond based on compounding. Coupon Bond Formula - WallStreetMojo Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond, Yield to Maturity (YTM) - WallStreetMojo Annual YTM will be - Therefore, the annual Yield on maturity shall be 4.43% * 2, which shall be 8.86%. Option 2 Coupon on the bond will be $1,000 * 8.50% / 2 which is $42.5, since this pays semi-annually. Yield to Maturity (Approx) = (42.50 + (1000 - 988) / (10 * 2))/ ( ( 1000 +988 )/2)

Ytm for coupon bond. Yield to Maturity Calculator | Calculate YTM The YTM can be thought of as the rate of return on a bond. If you hold the bond to maturity after buying it in the market and are able to reinvest the coupons at the YTM, the YTM will be the internal rate of return (IRR) of your bond investments. Zero Coupon Bond Value Calculator: Calculate Price, Yield ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months. Concept 82: Relationships among a Bond's Price, Coupon ... The yield-to-maturity is the implied market discount rate given the price of the bond. Relationship with bond's price. A bond's price moves inversely with its YTM. An increase in YTM decreases the price and a decrease in YTM increases the price of a bond. The relationship between a bond's price and its YTM is convex. Yield to Maturity Calculator | Good Calculators r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to Maturity?

Yield to Maturity (YTM) - Corporate Finance Institute On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity Yield to Maturity (YTM) - InvestingAnswers The bond will mature in 6 years and the coupon rate is 5%. To determine the YTM, we'll use the formula mentioned above: YTM = t√$1,500/$1,000 - 1 The estimated YTM for this bond is 13.220%. How Yield to Maturity Is Calculated (for Zero Coupon Bonds) Since zero coupon bonds don't have recurring interest payments, they don't have a coupon rate. Yield to Maturity (YTM) - WallStreetMojo Annual YTM will be - Therefore, the annual Yield on maturity shall be 4.43% * 2, which shall be 8.86%. Option 2 Coupon on the bond will be $1,000 * 8.50% / 2 which is $42.5, since this pays semi-annually. Yield to Maturity (Approx) = (42.50 + (1000 - 988) / (10 * 2))/ ( ( 1000 +988 )/2) Coupon Bond Formula - WallStreetMojo Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond,

Yield to Maturity - Study Finance Yield to maturity (YTM) is the total expected return from a bond when it is held until maturity - including all interest, coupon payments, and premium or discount adjustments. The YTM formula is used to calculate the bond's yield in terms of its current market price and looks at the effective yield of a bond based on compounding.

Post a Comment for "44 ytm for coupon bond"