39 coupon rate vs ytm

corporatefinanceinstitute.com › resourcesYield to Maturity (YTM) - Overview, Formula, and Importance May 07, 2022 · Yield to Maturity (YTM) – otherwise referred to as redemption or book yield – is the speculative rate of return or interest rate of a fixed-rate security, such as a bond. The YTM is based on the belief or understanding that an investor purchases the security at the current market price and holds it until the security has matured (reached ... Yield to Maturity (YTM) vs. Spot Rate: What's the Difference? Investopedia contributors come from a range of backgrounds, and over 20+ years there have been thousands of expert writers and editors who have contributed.

Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a $1,000 bond with a coupon rate of 6% pays ...

Coupon rate vs ytm

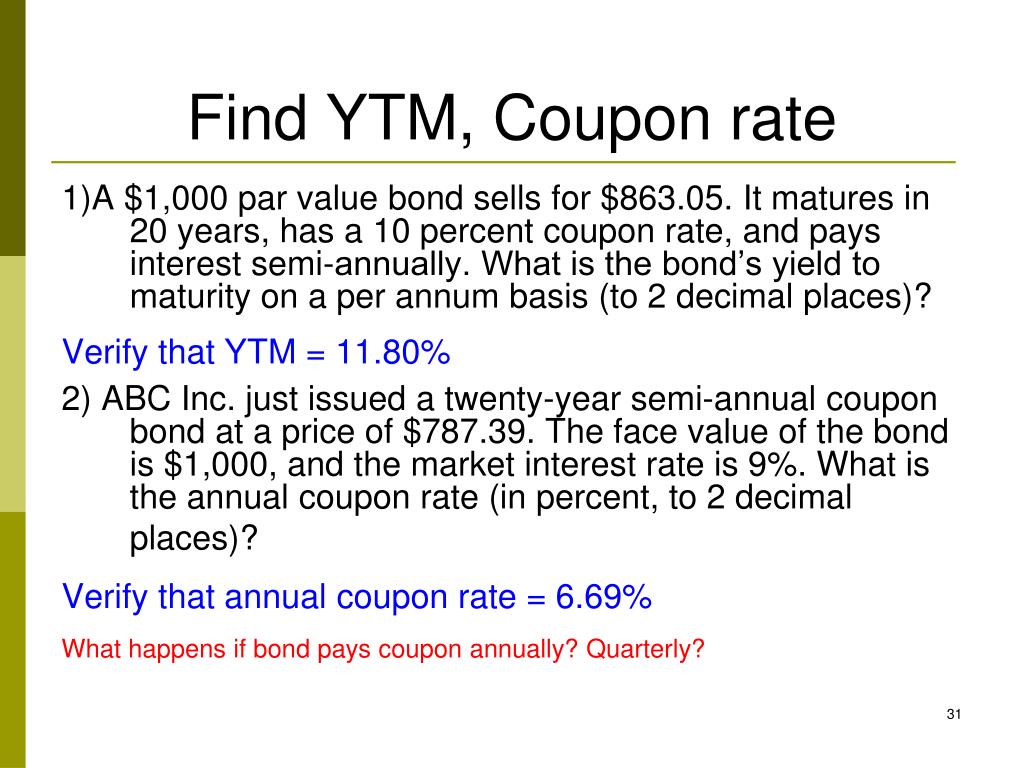

› yield-to-maturity-ytmYield to Maturity (YTM): Formula and Excel Calculator The coupon payments were reinvested at the same rate as the yield-to-maturity (YTM). Said differently, the yield to maturity (YTM) on a bond is its internal rate of return (IRR) – i.e. the discount rate which makes the present value (PV) of all the bond’s future cash flows equal to its current market price. Yield to Maturity (YTM) Formula Realized Compound Yield versus Yield to Maturity - Rate Return With a reinvestment rate equal to the 10% yield to maturity, the realized compound yield equals yield to maturity. But what if the reinvestment rate is not 10%? If the coupon can be invested at more than 10%, funds will grow to more than $1,210, and the realized compound return will exceed 10%. If the reinvestment rate is less than 10%, so will ... Understanding the Yield to Maturity (YTM) Formula | SoFi The bond will reach maturity in 10 years, with a coupon rate of about 14%. By using this formula, the estimated yield to maturity would calculate as follows: The Importance of Yield to Maturity. Knowing a bond's YTM can help investors compare bonds with various maturity and coupon rates.

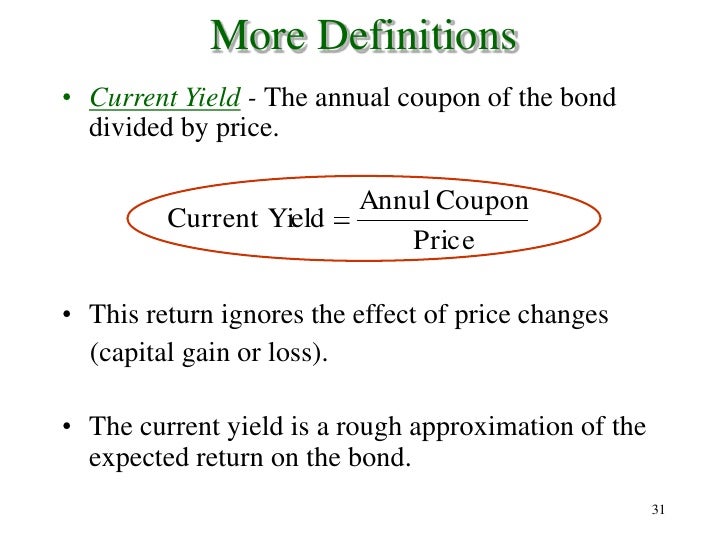

Coupon rate vs ytm. Difference Between YTM and IRR The yield to maturity or YTM is used to evaluate bond features that include time to maturity, Current Coupon interest rates, early redemption prices, and the frequency of interest payments. And to calculate the item bond value table is used, which is also known as the bond yields table. Current Yield vs. Yield to Maturity: What's the Difference? Yield to maturity is a way to compare bonds with different market prices, coupon rates, and maturities. Formula The current yield of a bond is easily calculated by dividing the coupon payment by the price. For example, a bond with a market price of $7,000 that pays $70 per year would have a current yield of 7%. 3 Difference Between Current Yield and Coupon Rate The main difference between the current yield and coupon rate is that the current yield is just an expected return from a bond, and the coupon rate is the actual amount paid regularly for a bond till it gets mature. The Current Yield keeps changing as the market value of the bond changes, but the Coupon Rate of a particular bond remains the same. What is a Coupon Value? Definition and Calculation We will define the coupon rate, examine the yield to maturity vs. coupon rate difference, and show you how to calculate coupon rates. What is a Coupon Rate - Explained. A coupon rate refers to annual payments a bond issuer must make to investors. Bonds are fixed-income securities, meaning the scheduled payments are fixed irrelevant of market ...

YTM AND ITS INVERSE RELATION WITH MARKET PRICE | India Example 1 (YTM calculation): YTM on a bond with a face value of ₹100, market price of ₹110, annual coupon rate of 7.5% paid semi-annually, term to maturity of 9 years, will be 6.085% Difference Between Coupon Rate and Discount Rate the main difference between the coupon rate and the discount rate is that a coupon rate alludes to the rate which is determined on the face worth of the security, i.e., it is the yield on the proper pay security that is generally affected by the public authority set discount rates, and it is usually settled by the backer of the guards while … Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity Annual Coupon Rate (%) - The annual interest rate paid on the bond's face value. Coupon Payment Frequency - How often the bond pays out interest every year. Calculator Outputs. Yield to Maturity (%): The yield you'd recognize holding the bond until maturity (assuming you receive all payments). Macaulay Duration (Years) - Weighted average time (in years) for a payout from … Coupon Rate - Meaning, Calculation and Importance - Scripbox The main distinction between the coupon rate and YTM is the return estimation. The coupon rate payments are the same for the bond tenure. While the yield on maturity varies depending on various factors such as the number of years till maturity and the current trading price of the bond. Let's assume the couponrate for a bond is 15%.

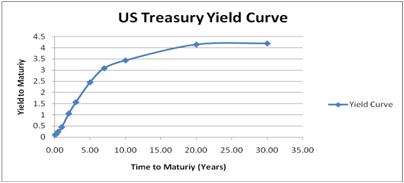

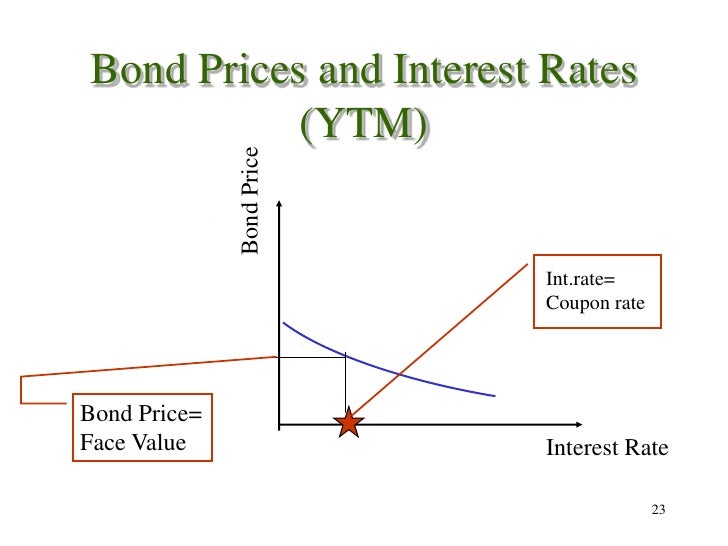

CFA Level 1 Fixed Income: Our Cheat Sheet - 300Hours Bond price is inversely related to YTM, the higher the YTM the lower the price, and vice versa. Convexity effect: Bond price is more sensitive to discount rate reduction than discount rate increases. Coupon effect: If all else constant, bonds with lower coupon rates are more sensitive to discount rate changes. Maturity effect CFA Level 1: Market Rate of Return & YTM Bond Price vs Coupons. As you probably remember the price of a bond may be: higher than the par value. Then, we say that the bond sells at a premium. ... zero-coupon bonds are characterized by the greatest sensitivity of the bond's price to changes in the market discount rate. Yield to maturity is the annual rate that a bondholder will earn ... › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Coupon Rate = Reference Rate + Quoted Margin The quoted margin is the additional amount that the issuer agrees to pay over the reference rate. For example, suppose the reference rate is a 5-year Treasury Yield, and the quoted margin is 0.5%, then the coupon rate would be - Coupon Rate = 5-Year Treasury Yield + .05%

Bond Basics: Issue Size and Date, Maturity Value, Coupon 28.05.2022 · Coupon and Yield to Maturity . The coupon rate is the periodic interest payment that the issuer makes during the life of the bond. For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures. The term “coupon” comes from the days when investors would ...

en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia The yield to maturity (YTM), book yield or redemption yield of a bond or other fixed-interest security, such as gilts, is an estimate of the total rate of return anticipated to be earned by an investor who buys a bond at a given market price, holds it to maturity, and receives all interest payments and the capital redemption on schedule.

Duration vs. Maturity and Why the Difference Matters 01.09.2017 · See the diagram below to understand the relationship between the bond’s price and its interest rate (or coupon rate). A bond is quoted with its “coupon yield”. This refers to the annual interest payable as a percent of the original face or par value. An 8% bond with a par value of 1000 would receive $80 per year. Coupon/Interest Rate= 8% ...

Yield to Maturity vs. Coupon Rate: What's the Difference? 20.05.2022 · Yield to Maturity vs. Coupon Rate: An Overview When investors consider buying bonds they need to look at two vital pieces of information: the yield to …

› terms › cCoupon Rate Definition - Investopedia Sep 05, 2021 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

› bond-basics-417057Bond Basics: Issue Size and Date, Maturity Value, Coupon May 28, 2022 · Coupon and Yield to Maturity . The coupon rate is the periodic interest payment that the issuer makes during the life of the bond. For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures.

Coupon Rate Formula & Calculation | Coupon Rate vs. Interest Rate ... The coupon rate is also different from the yield to maturity (YTM). The yield to maturity measures the rate of return, assuming that the investor will keep the bond until its maturity. The yield to...

Yield to Maturity (YTM) - Overview, Formula, and Importance 07.05.2022 · Yield to Maturity (YTM) – otherwise referred to as redemption or book yield – is the speculative rate of return or interest rate of a fixed-rate security, such as a bond. The YTM is based on the belief or understanding that an investor purchases the security at the current market price and holds it until the security has matured (reached its full value), and that all interest and …

Equity vs Fixed Income - A Side by Side Comparison 04.02.2022 · The yield-to-maturity (YTM), is the single discount rate that matches the present value of the bond’s cash flows to the bond’s price. YTM is best used as an alternative way to quote a bond’s price. For a bond with annual coupon rate c% and T years to maturity, the YTM (y) is given by: Macaulay Duration (D), and subsequently Modified Duration (D*), are used to …

Coupon Rate Definition - Investopedia 05.09.2021 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Yield to Maturity vs Coupon Rate - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is bought by an investor and held to maturity. Coupon rate is a fixed value in relation to the face value of a bond. If yield to maturity is greater than the coupon rate, the bond is trading at a discount to its par value.

Yield to Maturity (YTM) Definition - Investopedia Yet, unlike current yield, YTM accounts for the present valueof a bond's future coupon payments. In other words, it factors in the time value of money, whereas a simple current yield calculation...

Bond Yield Rate Vs. Coupon Rate: What's The Difference? The current yield compares the coupon worth to the current market price of the bond. Therefore, if a $1,000 bond with a 6% coupon worth sells for $1,000, then the current yield will be 6%. However, because of the market price of bonds can fluctuate, it is perhaps doable to purchase this bond for a price that is above or below $1,000.

Yield to Maturity (YTM): Formula and Excel Calculator Annual Coupon Rate (%): 6.0%; Number of Years to Maturity: 10 Years; Price of Bond (PV): $1,050; We’ll also assume that the bond issues semi-annual coupon payments. Given those inputs, the next step is to calculate the semi-annual coupon rate, which we can calculate by dividing the annual coupon rate by two. Semi-Annual Coupon Rate (%) = 6.0% ...

investspectrum.com › uma › duration-vs-maturityDuration vs. Maturity and Why the Difference Matters Sep 01, 2017 · See the diagram below to understand the relationship between the bond’s price and its interest rate (or coupon rate). A bond is quoted with its “coupon yield”. This refers to the annual interest payable as a percent of the original face or par value. An 8% bond with a par value of 1000 would receive $80 per year. Coupon/Interest Rate= 8% ...

Yield to maturity - Wikipedia If a bond's coupon rate is more than its YTM, then the bond is selling at a premium. If a bond's coupon rate is equal to its YTM, then the bond is selling at par. Variants of yield to maturity. As some bonds have different characteristics, there are some variants of YTM: Yield to call (YTC): when a bond is callable (can be repurchased by the issuer before the maturity), the market …

Difference Between Coupon Rate and Yield to Maturity The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year.

How to calculate yield to maturity in Excel (Free Excel Template) Coupon Rate, rate = 6%; Coupons per Year, nper = 4 (quarterly) Years of Maturity = 10; Now, you went to a bond rating agency (Moody's, S&P, Fitch, etc.) and they rated your bond as AA+. More about the bond rating. But the problem is: when you tried to sell the bond, you see that the same rated bond is selling with 7.5% YTM (yield to maturity).

![[Udemy 100% Off Discount Coupon]-Become A Conversion Rate Optimization ...](https://i.pinimg.com/736x/19/78/8d/19788d460ed21bceb3a4897a3207d411.jpg)

![[20% OFF] Video Profit Site Coupon Discount Code - BulkCouponCodes](https://bulkcouponcodes-48e0.kxcdn.com/wp-content/uploads/2019/12/2019-12-05_6-58-45.png)

Post a Comment for "39 coupon rate vs ytm"