42 how to find the coupon payment

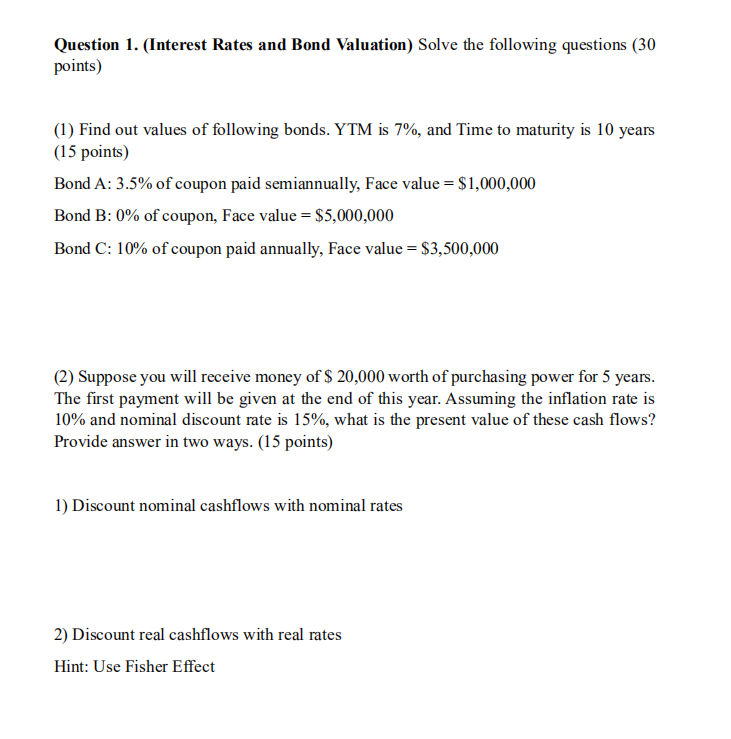

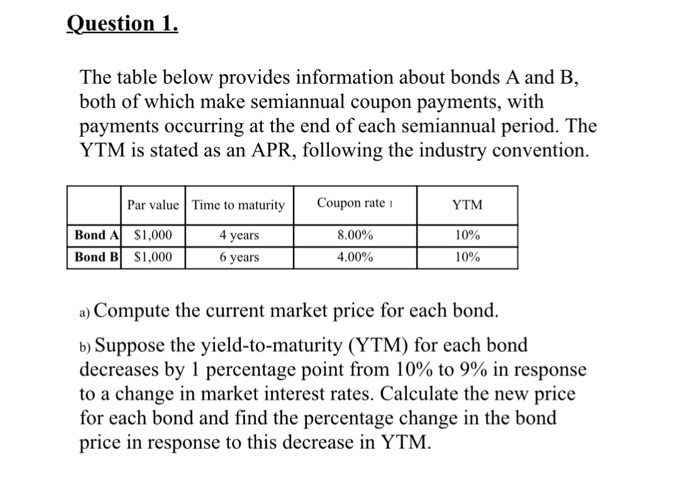

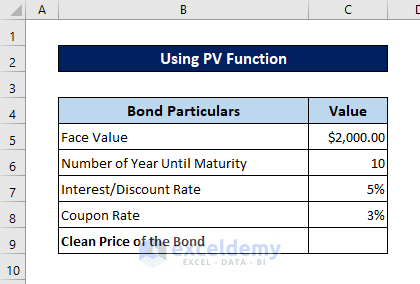

How to Calculate Bond Price in Excel (4 Simple Ways) Use the below formula in the C11 cell to find the Coupon Bond price. =C10* (1- (1+ (C8 /C7))^ (-C7*C6 ))/ (C8/C7)+ (C5/ (1 + (C8/C7))^ (C7*C6)) Use the ENTER key to display the Coupon Bond Price. 🔄 Zero-Coupon Bond Price Calculation Also, using the conventional formula you can find the zero-coupon bond price. Coupon Rate Formula | Step by Step Calculation (with Examples) Total annual coupon payment = Periodic payment * No. of payments in a year Finally, the coupon rate is calculated by dividing the total annual coupon payment by the par value of the bond and multiplied by 100%, as shown above. Examples You can download this Coupon Rate Formula Excel Template here - Coupon Rate Formula Excel Template Example #1

How to Calculate a Coupon Payment | Sapling In finance, a coupon payment represents the interest that's paid on a fixed-income security such as a bond. Par value is the face value of a bond. Calculate the annual coupon rate by figuring the annual coupon payment, dividing this amount by the par value and multiplying by 100 percent.

How to find the coupon payment

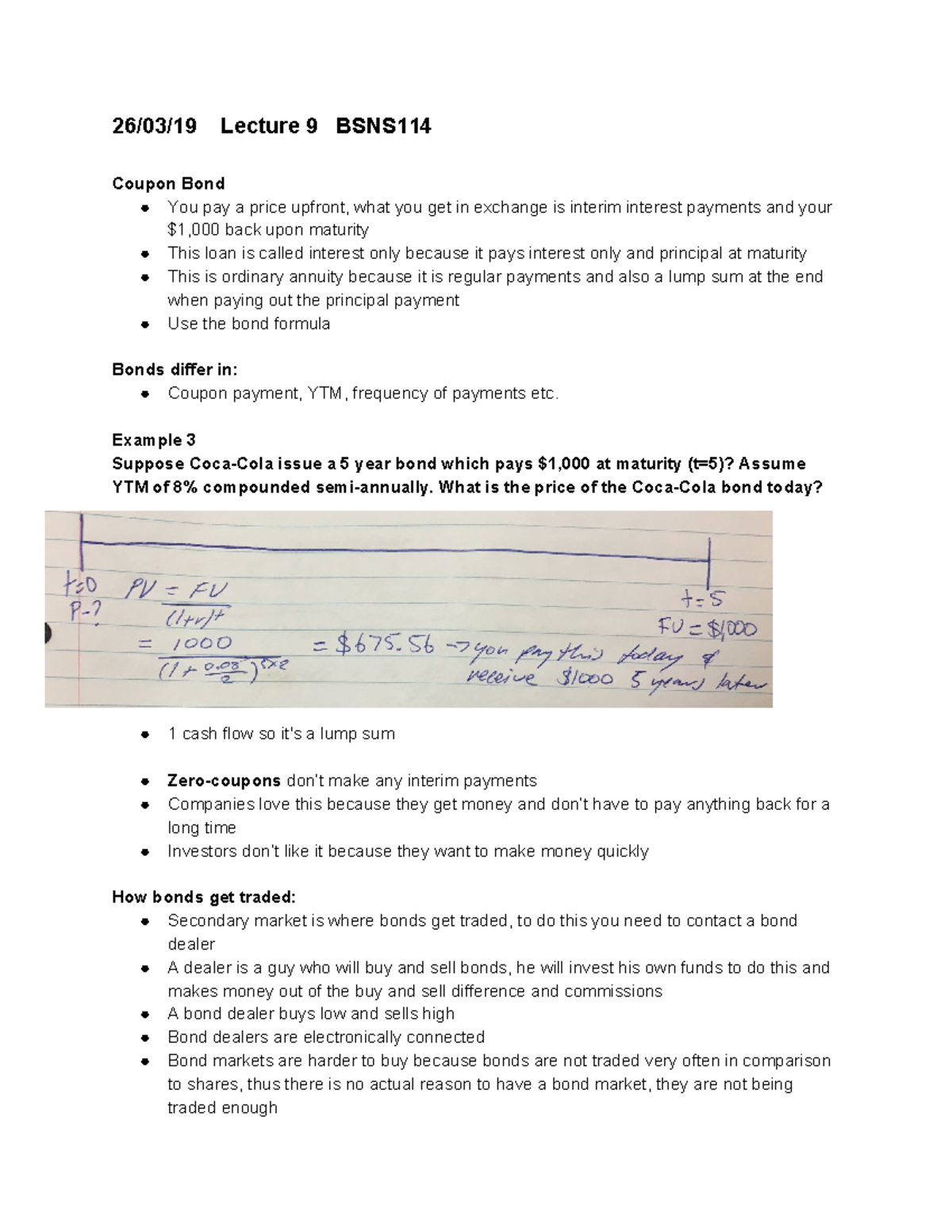

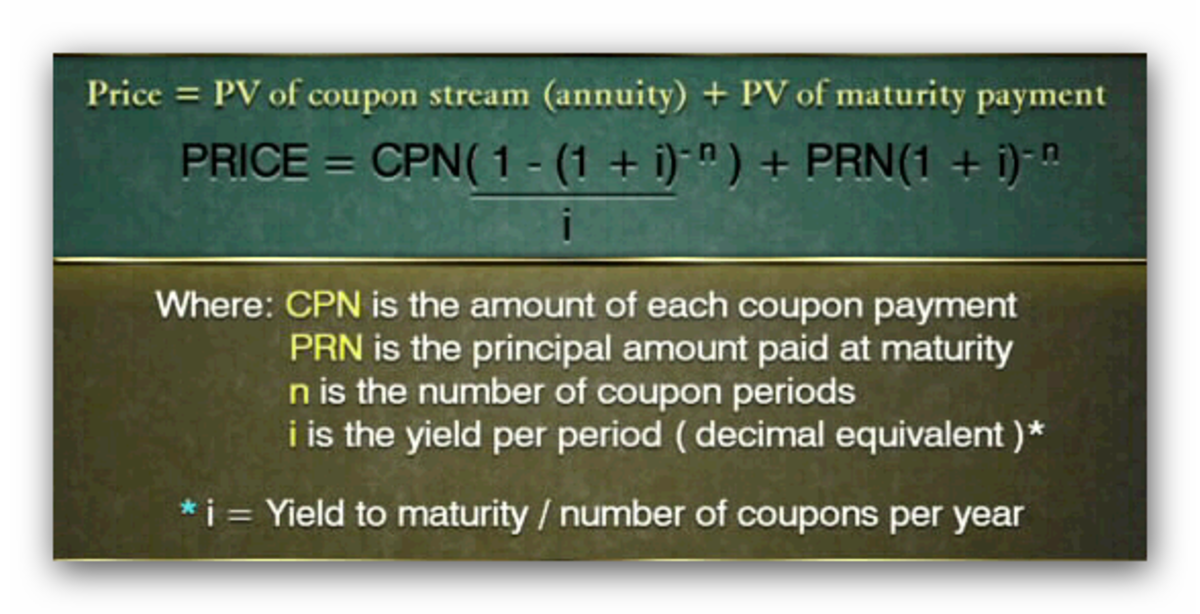

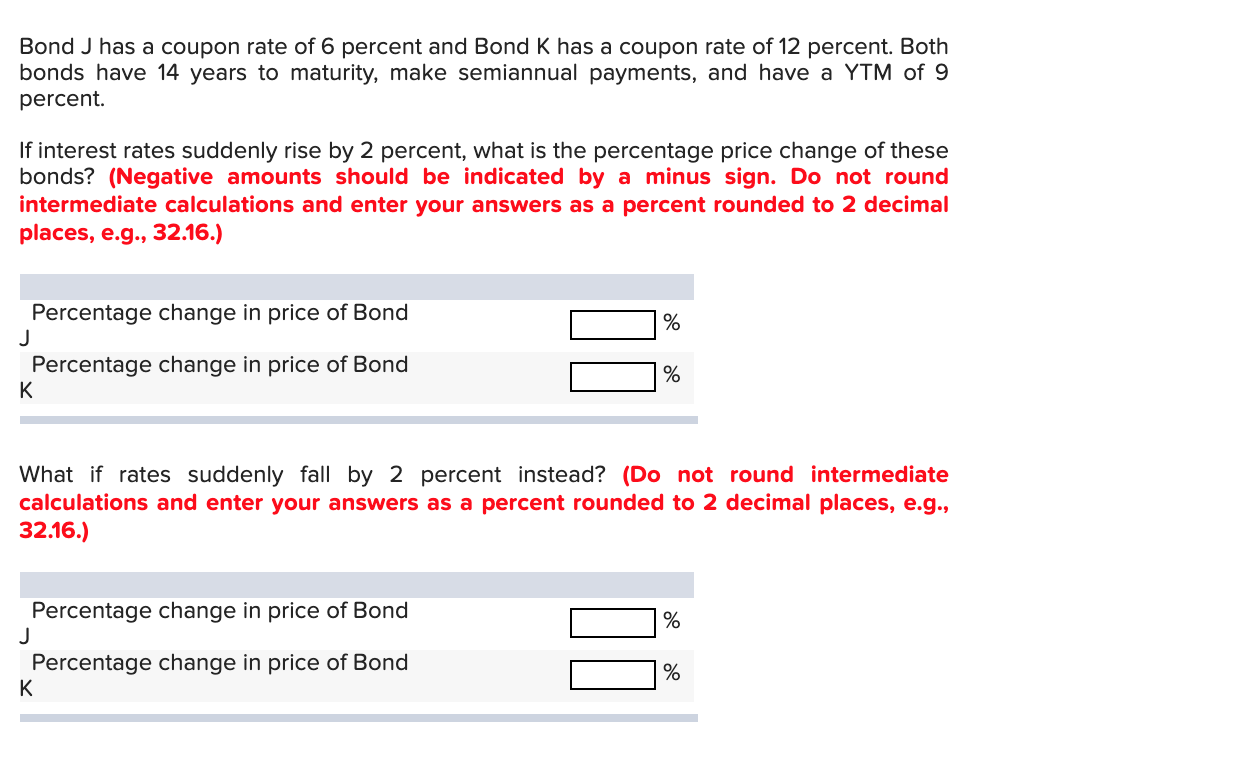

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Regardless of the direction of interest rates and their impact on the price of the bond, the coupon rate and the ... How to Calculate the Price of Coupon Bond? - WallStreetMojo The coupon payment is denoted by C, and it is calculated as C = Coupon rate * P / Frequency of coupon payment Next, determine the total number of periods till maturity by multiplying the frequency of the coupon payments during a year and the number of years till maturity. On what date was a coupon payment last date? would it always be before ... Unless explicitly defined otherwise, the first payment will be made 6 months after the issuance and every 6 months after that (some bonds have the first interest payment immediately and the last interest payment is made the period before the maturity date). The final interest payment will be paid at maturity, along with the face value of the bond.

How to find the coupon payment. Esri Training Learn the latest GIS technology through free live training seminars, self-paced courses, or classes taught by Esri experts. Resources are available for professionals, educators, and students. Subscribe to Find-A-Code MS-DRG's and LTC DRG Weights, MS-DRG Grouper & Payment Calculator Enter ICD-10-CM and ICD-10-PCS codes, Present on Admission values, date of service, age/gender, discharge status, and click Group MS-DRG grouping result will appear below, including details such as DRG Relative Weight, Length of Stay information, etc. How to Calculate the Value of a Treasury Note | Pocketsense If the example note offered a 4 percent coupon rate, multiply 0.02 times $100 to get a coupon payment of $2. Multiplying this by 27.541 derives the coupon payments' NPV of $55.08. Add the face value's NPV to get the Treasury note's value. In the example, the note would be worth $72.45 compared to the alternate safe-bet investment. Coupon Rate: Formula and Calculation - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

How to Calculate a Coupon Payment: 7 Steps (with Pictures) To calculate the payment based on the current yield, just multiply the current yield times the amount that you paid for the bond (note, that might not be the same as the bond's face value). For example, if you paid $800 for a bond and its current yield is 10%, your coupon payment is .1 * 800 or $80. [7] 3 Calculate the payment by frequency. Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Use this simple finance coupon rate calculator to calculate coupon rate. AZCalculator.com. Home (current) ... › Finance › Economic Benefits. Posted by Dinesh on 27-06-2021T07:56. This calculator calculates the coupon rate using face value, coupon payment values. Coupon Rate Calculation. Face Value $ Coupon Payment $ Submit Reset. Coupon ... Loan Payment Coupon Book Alternatives - The Balance Make sure the following items are included in your coupon: Your name and address. Your contact information (especially a phone number to call if there are any questions about your payment) Your account number with the lender. Your payment due date. The amount of your payment. Any other information about your loan (to help your lender find your ... Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated by dividing Annual Coupon Payment by Face Value of Bond, the result is expressed in percentage form. The formula for Coupon Rate - Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Below are the steps to calculate the Coupon Rate of a bond:

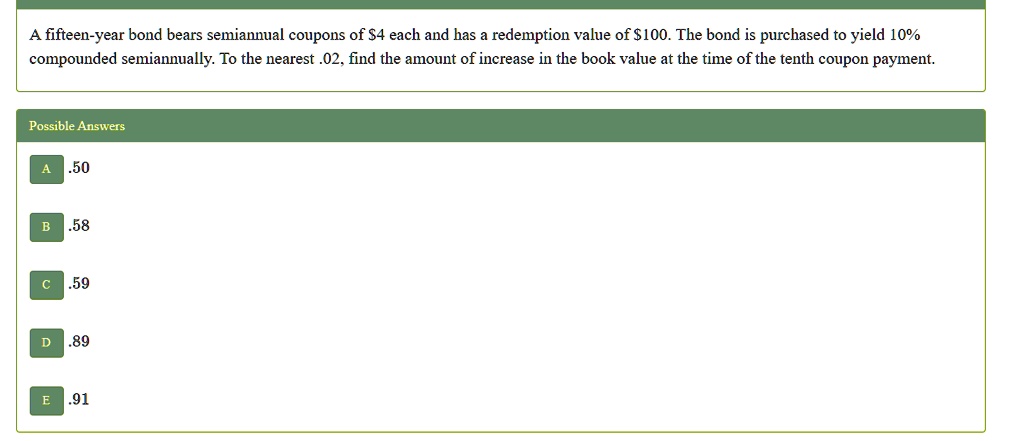

Coupon Bond Formula | Examples with Excel Template - EDUCBA The coupon payment is the product of the coupon rate and the par value of the bond. It also does not change over the course of the bond tenure. The annual coupon payment is denoted by C and mathematically represented as shown below. C = Annual Coupon Rate * F How to Calculate the Price of a Bond With Semiannual Coupon Interest ... Multiplying the results by the eight coupon payments and the one final face-value payment discounts them to $24.27, $23.56, $22.88, $22.21, $21.57, $20.94, $20.33, $19.74 and $789.41, respectively. Summing and Pricing. Add the results of the previous calculations to achieve a total present value. Concluding the example, adding the present ... How to Calculate an Interest Payment on a Bond: 8 Steps - wikiHow Find the monthly interest. If the bond pays monthly, the exact same approach as above would be used, but the $50 would be divided by 12, since there are 12 months in a year. In this case, $50 divided by 12 is $4.16, which means you would receive $4.16 monthly. You earn the interest only for the days you own the bond. How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In Excel, enter the coupon payment in cell A1. In cell A2, enter the number of coupon payments you receive each year. If the bond pays interest once a year, enter 1. If you receive payments...

Coupon Rate Formula & Calculation - Study.com Calculate the annualized coupon payments by summing all the periodic payments made during a given year. Divide the annualized coupon payments by the par value. Convert the resulted coupon rate to...

Coupon Rate Calculator | Bond Coupon You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time!

Find the coupon date of a bond 1 It will pay periodic coupons starting from the issue date. You can also work backwards from the maturity date. In your example the bond matures on March 6, 2022 and pays interest annually (although I find conflicting data from other sites) so it pays interest every March 6th (plus or minus a few days depending on what the prospectus says).

Coupon Definition - Investopedia Coupon rate or nominal yield = annual payments ÷ face value of the bond Current yield = annual payments ÷ market value of the bond The current yield is used to calculate other metrics, such as the...

How to Calculate the Bond Duration (example included) Therefore, for our example, m = 2. Here is a summary of all the components that can be used to calculate Macaulay duration: m = Number of payments per period = 2. YTM = Yield to Maturity = 8% or 0.08. PV = Bond price = 963.7. FV = Bond face value = 1000. C = Coupon rate = 6% or 0.06. Additionally, since the bond matures in 2 years, then for ...

Coupon Payment | Definition, Formula, Calculator & Example Coupon payment for a period can be calculated using the following formula: Where F is the face value of the bond, c is the annual coupon rate and n represents the number of payments per year. Coupon Payment Calculator Example Walmart Stores Inc. has 3 million, $1,000 par value bonds payable due on 15th August 2037.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

NHS Test and Trace: what to do if you are contacted - GOV.UK May 27, 2020 · If you are not on one of these benefits, you might still be eligible for a £500 discretionary payment from your local authority. See Test and Trace Support Payment scheme: claiming financial support.

Coupon Payment Calculator You can quickly calculate the coupon payment for each payment period using the coupon payment formula: Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50

Car Payment Estimator - Lease and Finance Options - BMW USA An Owners’ Choice contract is a retail installment financing option that includes a final balloon payment. Available only in select states, Owners’ Choice offers lower monthly payments (similar in amount to a lease payment), and a balloon payment that may be satisfied by returning the vehicle.

Used Cars for Sale Right Now - Autotrader Test drive Used Cars at home from the top dealers in your area. Search from 1553109 Used cars for sale, including a 2007 Lamborghini Gallardo Spyder, a 2010 Ford Explorer XLT, and a 2011 Dodge Challenger SRT8 ranging in price from $500 to $4,299,999.

How to Get Coupons in 2022 (11 Best Ways) - The Coupon Project If you're asking yourself where to find coupons, there's good news - they are everywhere! Table of Contents Where Can I Get Coupons? 1. Sunday Newspaper 2. Weekly Grocery Store Ads 3. Online Printable Coupons 4. Digital Coupons 5. Coupon Apps 6. At the Store 7. Social Media 8. Mailing Lists 9. Inside Products and Packages 10. Magazines 11.

How to Calculate Coupon Rate in Excel (3 Ideal Examples) 2. Calculate Coupon Rate with Monthly Interest in Excel. In the following example, we will calculate the coupon rate with monthly interest in Excel. This is pretty much the same as the previous example but with a basic change. Monthly interest means you need to pay the interest amount each month in a year. So, the number of payments becomes 12 ...

How To Find Coupon Rate Of A Bond On Financial Calculator Divide the coupon payment amount by the face value. Multiply the result by 100 to get the percentage. For example, you have a $1,000 bond with a $50 coupon payment. To calculate the coupon rate, you would divide $50 by $1,000 and multiply by 100. The result is 5%, which means the bond pays 5% interest per year. Conclusion

COUPNCD: Calculating the next coupon date after the ... - LinkedIn To calculate the date of the next coupon payment you need to know four things. The first is the Settlement Date and that is the date that you took possession of the security. Next is the Maturity ...

Find the cheapest private lateral flow and PCR tests - MSE If a link has an * by it, that means it is an affiliated link and therefore it helps MoneySavingExpert stay free to use, as it is tracked to us. If you go through it, it can sometimes result in a payment or benefit to the site. It's worth noting this means the third party used may be named on any credit agreements.

On what date was a coupon payment last date? would it always be before ... Unless explicitly defined otherwise, the first payment will be made 6 months after the issuance and every 6 months after that (some bonds have the first interest payment immediately and the last interest payment is made the period before the maturity date). The final interest payment will be paid at maturity, along with the face value of the bond.

How to Calculate the Price of Coupon Bond? - WallStreetMojo The coupon payment is denoted by C, and it is calculated as C = Coupon rate * P / Frequency of coupon payment Next, determine the total number of periods till maturity by multiplying the frequency of the coupon payments during a year and the number of years till maturity.

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Regardless of the direction of interest rates and their impact on the price of the bond, the coupon rate and the ...

Post a Comment for "42 how to find the coupon payment"