44 zero coupon bond investopedia

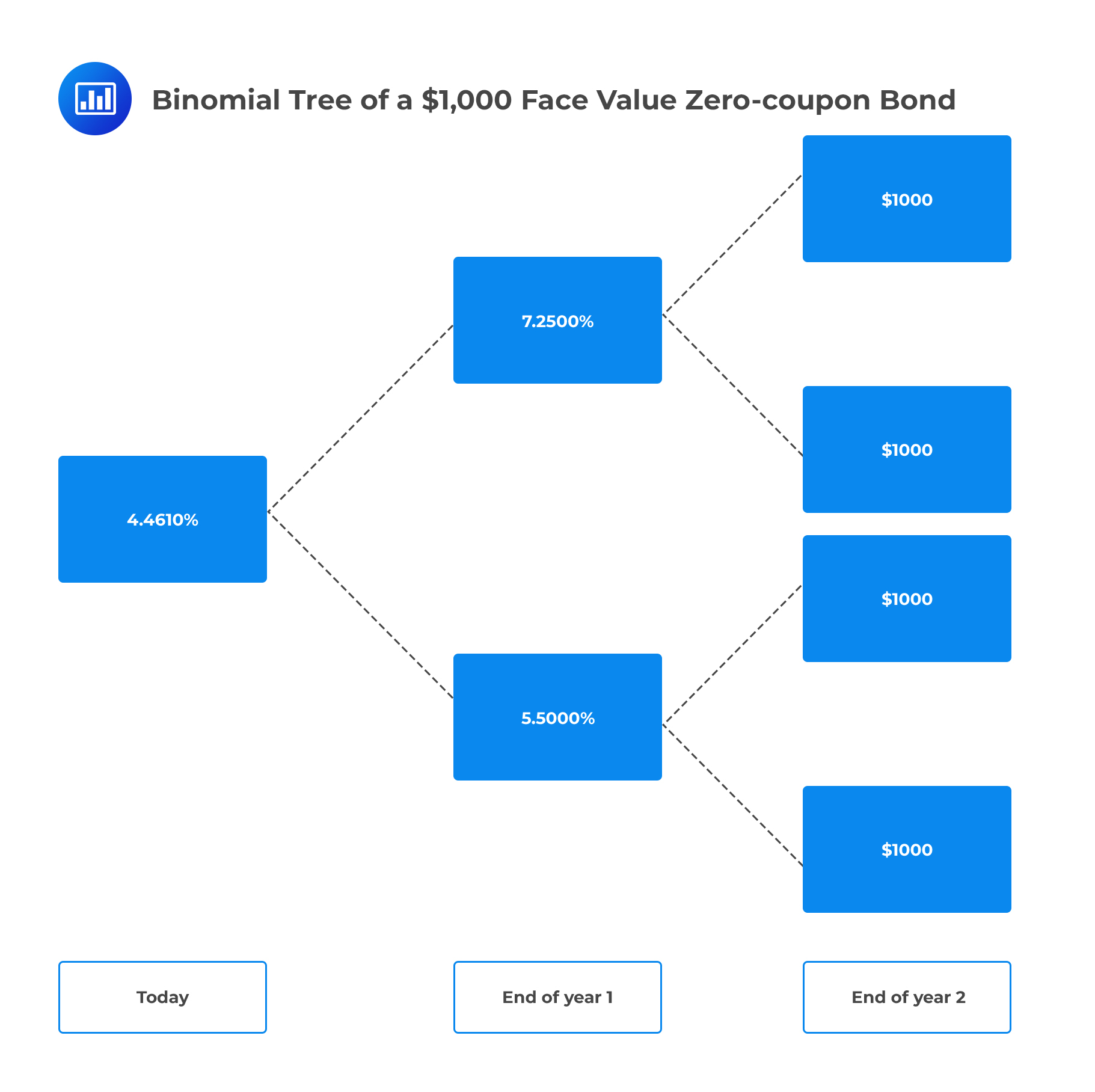

Bootstrapping (finance) - Wikipedia In finance, bootstrapping is a method for constructing a (zero-coupon) fixed-income yield curve from the prices of a set of coupon-bearing products, e.g. bonds and swaps.. A bootstrapped curve, correspondingly, is one where the prices of the instruments used as an input to the curve, will be an exact output, when these same instruments are valued using this curve. Zero Coupon Bond Value Formula With Calculator - Otosection Time the coupon value of the is is is zero zcbv a following the rate- t maturity- bond- r value of used the bond coupon the formula f 1 is bond is rt- value- fa

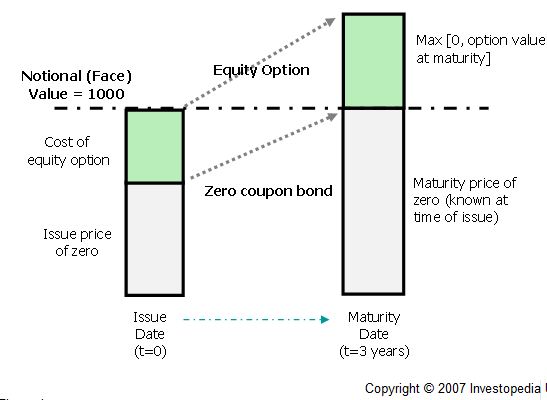

Zero coupon bonds - Chrome IAS A zero-coupon bond is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value. A zero-coupon bond is also known as an accrual bond. The difference between the purchase price of a zero-coupon bond and the par value, indicates the investor ...

Zero coupon bond investopedia

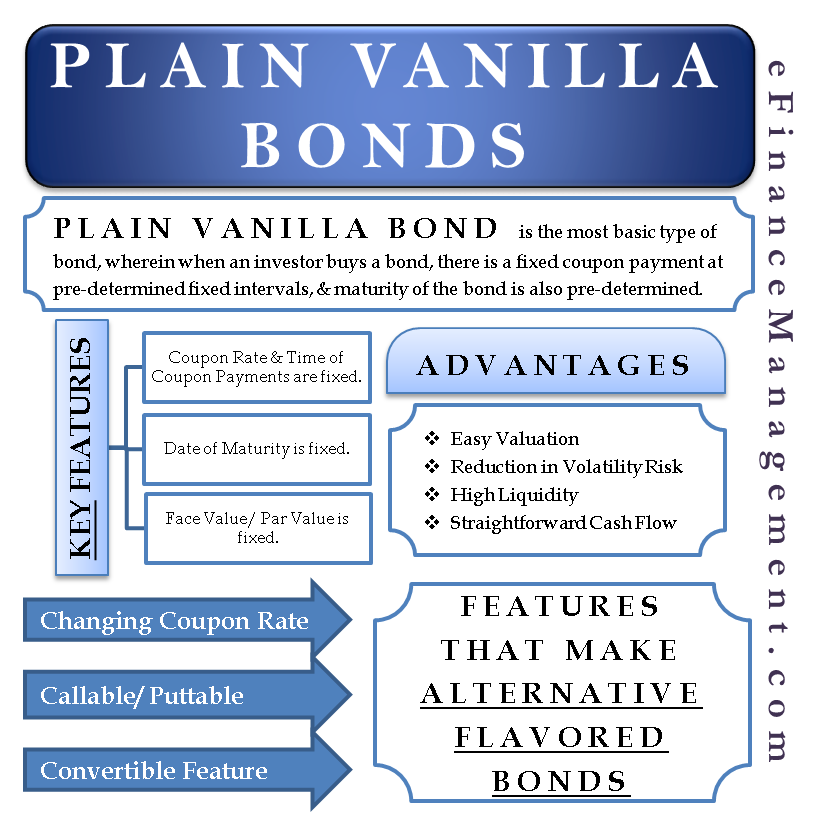

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for... Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. Bond s nulovým kupónom. (Zero-Coupon Bond) - Investopedia Bond s nulovým kupónom. (Zero-Coupon Bond) - Investopedia Bond s nulovým kupónom. (Zero-Coupon Bond) Čo je to dlhopis s nulovým kupónom. Dlhopis s nulovým kupónom je dlhový cenný papier, ktorý neplatí úroky, ale namiesto toho obchoduje s hlbokou zľavou, ktorá vytvára zisk pri splatnosti, keď je dlhopis splatený za celú nominálnu hodnotu.1

Zero coupon bond investopedia. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon U.S. Treasury bonds can move up significantly when the Fed cuts rates aggressively. 1 These gains can more than offset stock related losses, so Treasury zeros are often an excellent... Zero-Coupon Swap Definition - Investopedia A zero-coupon swap is a derivative contract entered into by two parties. One party makes floating payments which changes according to the future publication of the interest rate index (e.g. LIBOR,... Zero-Coupon Bond - The Investors Book Definition: A zero-coupon bond, as the name suggests, it is a financial instrument which does not allow a regular interest payment to the investor. Moreover, it is a bond which is issued at a meagre market price (discounted price) in comparison to its face value. And it is redeemable on or after a specified maturity date at the par value itself. Zero-Coupon Certificate of Deposit (CD) Definition - Investopedia A zero-coupon CD is a type of CD that does not pay interest throughout its term. Instead, the investor is compensated by receiving a face value upon maturity that is higher than the instrument's...

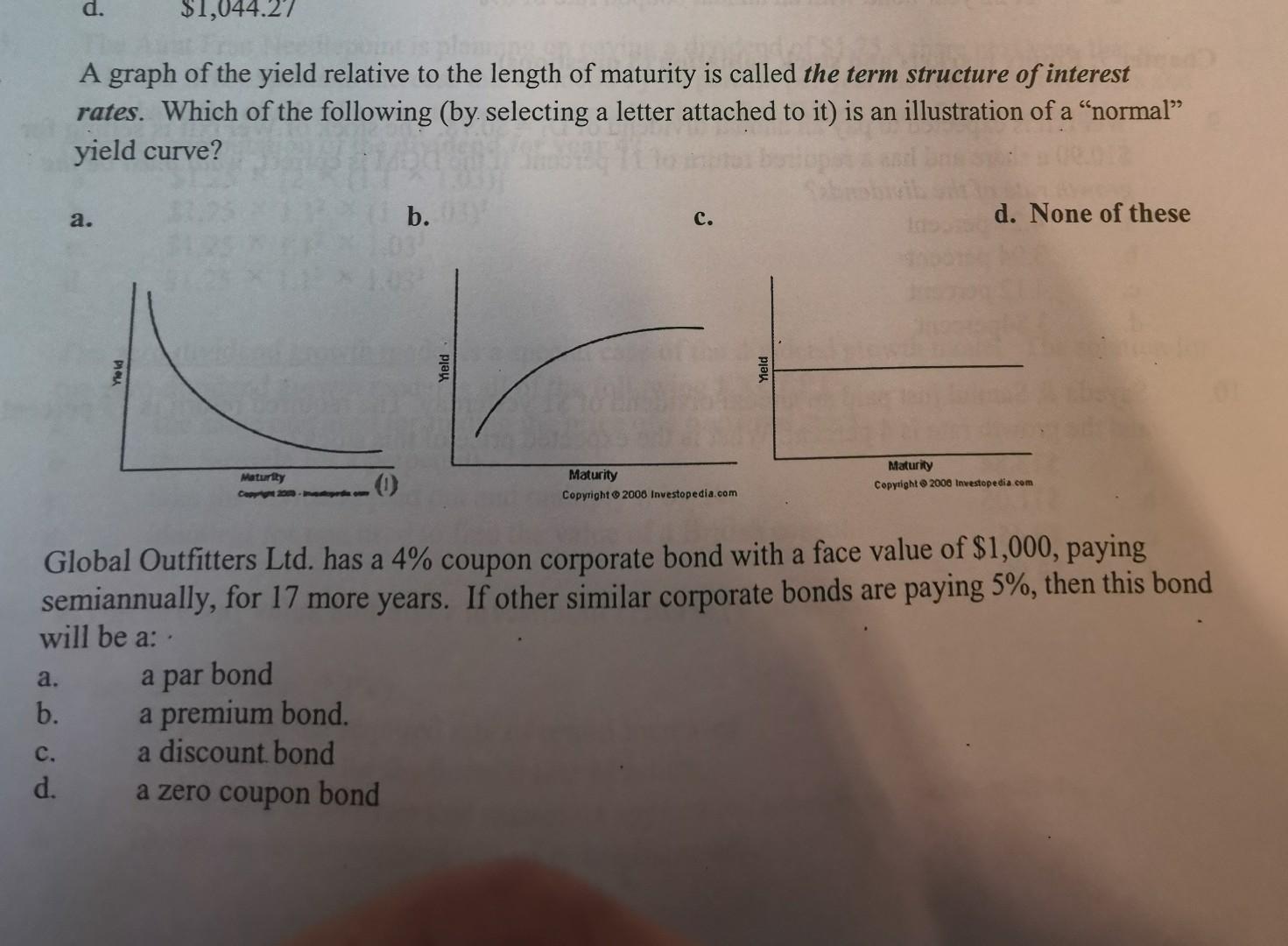

What Is a Zero Coupon Yield Curve? - Smart Capital Mind The zero coupon rate is the return, or yield, on a bond corresponding to a single cash payment at a particular time in the future. This would represent the return on an investment in a zero coupon bond with a particular time to maturity. The zero coupon yield curve shows in graphical form the rates of return on zero coupon bonds with different ... What does it mean if a bond has a zero coupon rate? - Investopedia A zero coupon bond generally has a reduced market price relative to its par value because the purchaser must maintain ownership of the bond until maturity to turn a profit. A bond that sells for... Investopedia Video: Zero-Coupon Bond - YouTube A debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full face value. For more Investopedia videos,... How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Zero-coupon bonds essentially lock the investor into a guaranteed reinvestment rate. This arrangement can be most advantageous when interest rates are high and when placed in tax-advantaged...

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten ... Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. [1] Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value. Zero-Coupon Bond - Fincyclopedia A bond that accrues interest over its life. Accrued interest is only payable at the maturity date of the bond. More specifically, a zero coupon bond (or simply, zero) doesn't pay interest during its life, but rather it is typically sold to investors at a deep discount from its face value (i.e., the amount a bond will be worth at its maturity or due date). Descargar Investopedia Video Zero Coupon Bond Pour télécharger le mp3 de Investopedia Video Zero Coupon Bond, il suffit de suivre Investopedia Video Zero Coupon Bond mp3 If youre considering downloading MP3 songs for free there are some things you should take into account. The first is to make sure that the downloader you are using isnt cost-free, and its compatible with the software youre using. So, you can store the files anywhere ...

Zero-Coupon Bonds and Taxes - Investopedia A zero-coupon bond will usually have higher returns than a regular bond with the same maturity because of the shape of the yield curve. Zero-coupon bonds are more volatile than coupon bonds, so...

Zero-Coupon Bond Definition EssentialsTechnical AnalysisRisk ManagementNewsCompany NewsMarkets NewsCryptocurrency NewsPersonal Finance NewsEconomic NewsGovernment NewsSimulatorYour MoneyPersonal FinanceWealth ManagementBudgeting SavingBankingCredit CardsHome OwnershipRetirement PlanningTaxesInsuranceReviews RatingsBest Online BrokersBest Savings AccountsBest Home WarrantiesBest Credit CardsBest Personal LoansBest Student ...

Bond s nulovým kupónom. (Zero-Coupon Bond) - Investopedia Bond s nulovým kupónom. (Zero-Coupon Bond) - Investopedia Bond s nulovým kupónom. (Zero-Coupon Bond) Čo je to dlhopis s nulovým kupónom. Dlhopis s nulovým kupónom je dlhový cenný papier, ktorý neplatí úroky, ale namiesto toho obchoduje s hlbokou zľavou, ktorá vytvára zisk pri splatnosti, keď je dlhopis splatený za celú nominálnu hodnotu.1

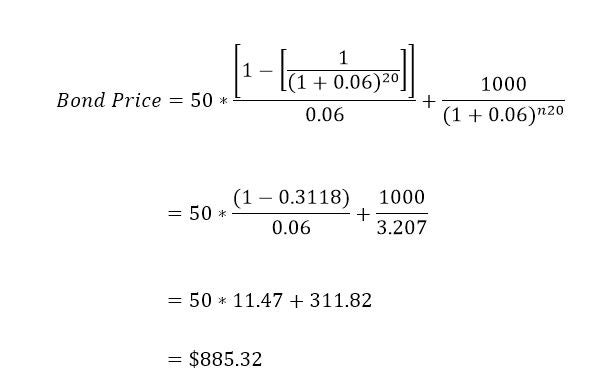

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value.

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for...

:max_bytes(150000):strip_icc()/dotdash_Final_Bond_Apr_2020-01-8b83e6be5db3474e896a93c1c1a9f169.jpg)

/low-angle-view-of-modern-financial-skyscrapers-in-central-business-district--hong-kong-at-sunrise-955431124-d9b03037841349a197324f20b6483b7d.jpg)

/virtual_goods-5bfc2b8a46e0fb00517bdfe5.jpg)

:max_bytes(150000):strip_icc()/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

:max_bytes(150000):strip_icc()/simple_bond_math_for_fixed-coupon_corporate_bonds-5bfc35a346e0fb00517dce6d.jpg)

:max_bytes(150000):strip_icc()/thinkstockphotos-479586547-5bfc34cf46e0fb00514690c4.jpg)

:max_bytes(150000):strip_icc()/bond-5bfc37fec9e77c00514745d5.jpg)

:max_bytes(150000):strip_icc()/are-bonds-safer-than-stocks-58dc27f03df78c5162810026.jpg)

:max_bytes(150000):strip_icc()/GettyImages-923217650-01788d623b954f9caef5eb87c1cdb15b.jpg)

Post a Comment for "44 zero coupon bond investopedia"