45 calculate coupon rate in excel

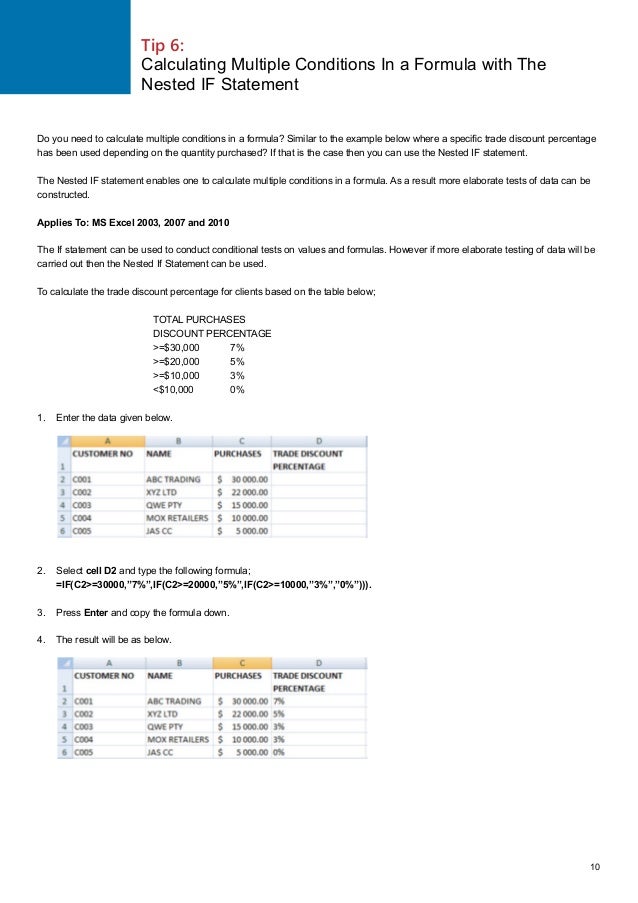

Calculating Coupon Rate In Excel - bizimkonak.com How To Calculate Coupon Payment In Excel? In cell A3, enter the formula "=A1*A2" to yield the total annual coupon payment. Moving down the spreadsheet, enter the par value of your bond in cell B1. How Can I Calculate a Bond's Coupon Rate in Excel? In Excel, enter the coupon payment in cell A1. In cell A2, enter the number of coupon payments you receive each year. If the bond pays interest once a year, enter 1. If you receive payments...

Coupon Rate: Formula and Bond Nominal Yield Calculator Coupon Rate = Annual Coupon / Par Value of Bond. For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000. Coupon Rate = 6%. Annual Coupon = $100,000 x 6% = $6,000. Since most bonds pay interest semi-annually, the bondholder receives two separate coupon payments of $3k ...

Calculate coupon rate in excel

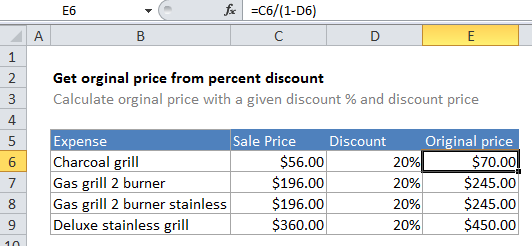

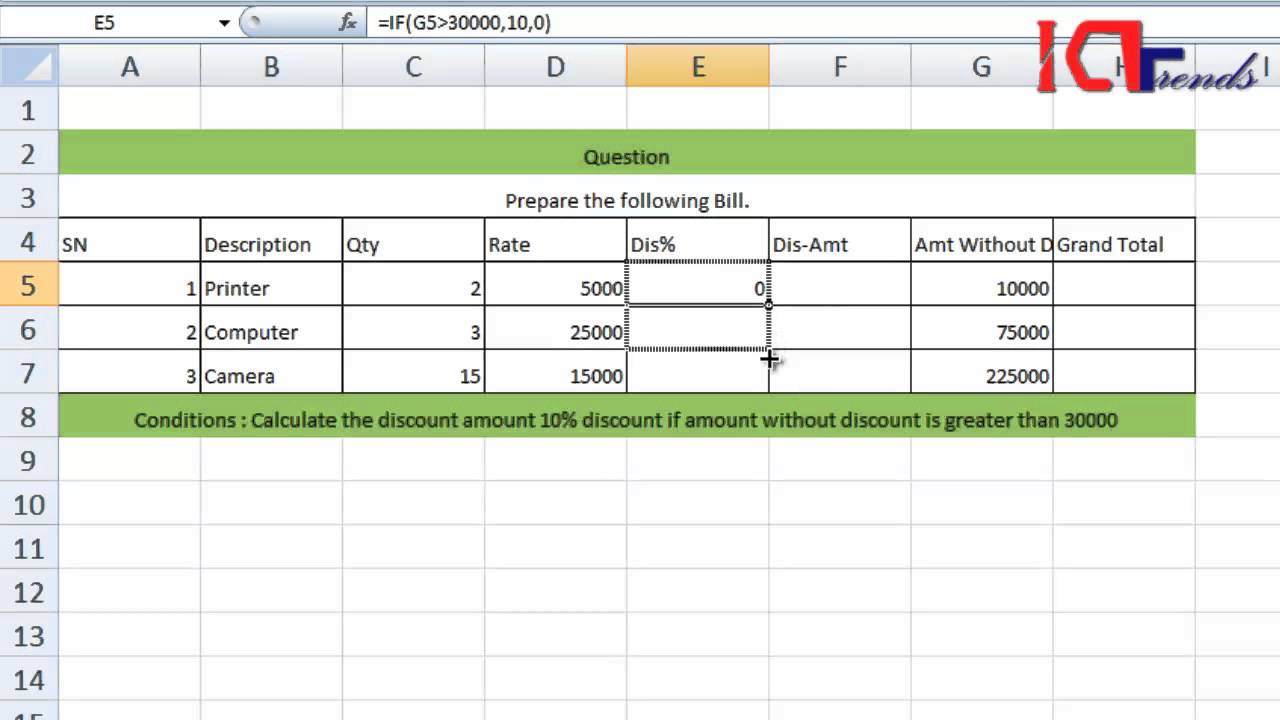

How to calculate discount rate or price in Excel? - ExtendOffice Calculate discount rate with formula in Excel The following formula is to calculate the discount rate. 1. Type the original prices and sales prices into a worksheet as shown as below screenshot: 2. What Is Coupon Rate and How Do You Calculate It? A bond's coupon price could be calculated by dividing the sum of the safety's annual coupon payments and dividing them by the bond's par worth. For instance, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. How to use the Excel COUPNCD function | Exceljet Syntax =COUPNCD (settlement, maturity, frequency, [basis]) Arguments settlement - Settlement date of the security. maturity - Maturity date of the security. frequency - Coupon payments per year (annual = 1, semi-annual = 2, quarterly = 4). basis - [optional] Day count basis (see below, default =0). Version Excel 2003 Usage notes

Calculate coupon rate in excel. › Calculate-Bond-ValueHow to Calculate Bond Value: 6 Steps (with Pictures) - wikiHow Apr 19, 2021 · Divide the discount rate required by the number of periods per year to arrive at the required rate of return per period, k. For example, if you require a 5% annual rate of return for a bond paying interest semiannually, k = (5% / 2) = 2.5%. Calculate the number of periods interest is paid over the life of the bond, or variable n. investexcel.net › how-to-calculate-mortgageHow to Calculate Mortgage Payments in Excel Here, I’ve formated the loan amount as currency, and the mortgage rate as a percent (right-click on each cell and click Format). Step 2: Calculate the Interest Rate Per Payment. Next, you’ll need to calculate the interest rate per payment. That’s given by this formula. Type it into Excel, as illustrated in the screengrab below. Using RATE function in Excel to calculate interest rate Simply by multiplying the RATE result by the number of periods per year, which is 12 in our case: =RATE (C2, C3, C4) * 12 The below screenshot lets you compare the monthly interest rate in C7 and the annual interest rate in C9: What if the payments are to be made at the end of each quarter? › modeling › calculateExcel Formula to Calculate Commissions with Tiered Rate ... May 15, 2013 · In the image below the Payout Rate for the 0%-40% range is 0.50. This means that for every 1% attained, the payout will be 0.50 of the 20% total payout. Payout Rate =([tier attainment max] – [tier attainment min]) / ([payout % this tier] – [payout % previous tier]) Rate Curve. The payout rate is also known as the rate curve. The rate curve ...

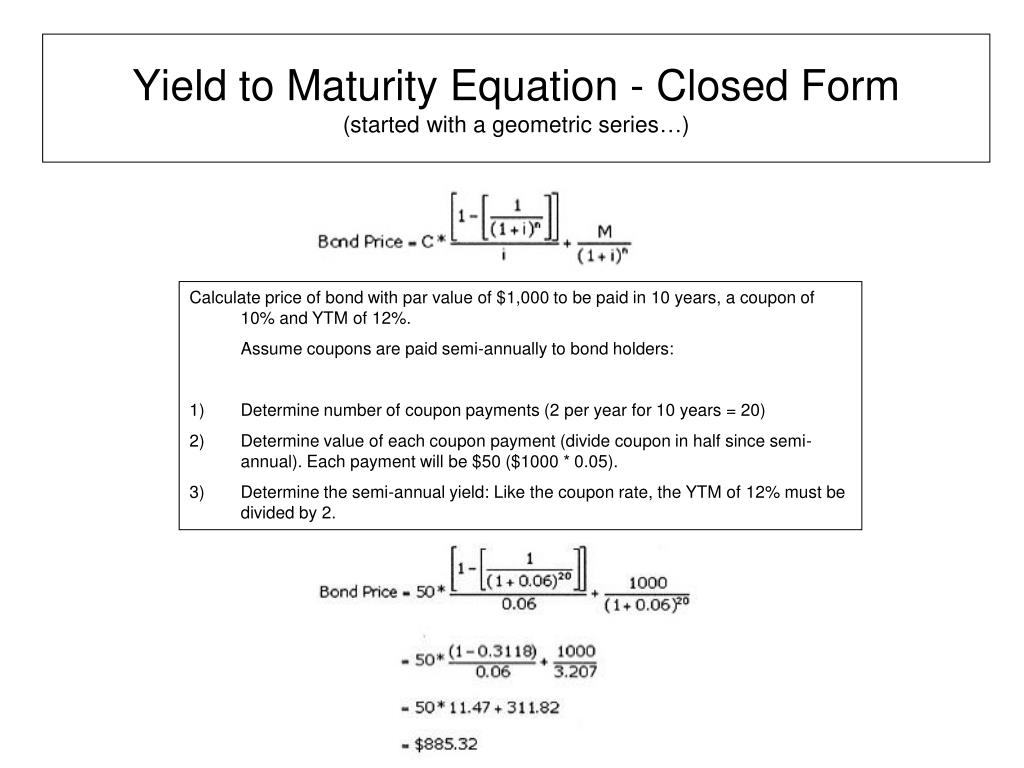

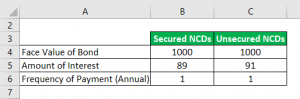

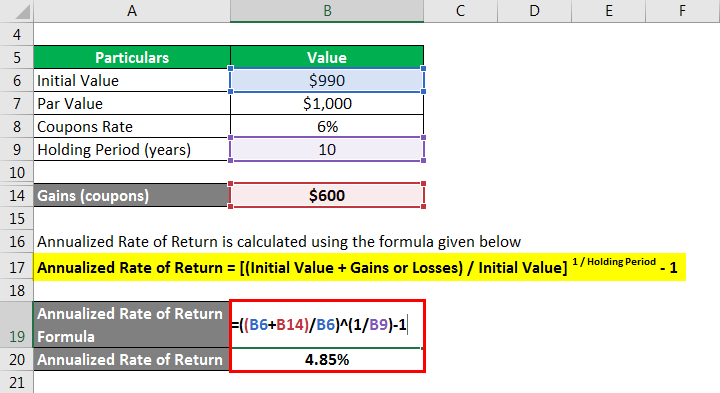

How to Calculate Coupon Rate in Excel (3 Ideal Examples) In Excel, we can also calculate the coupon bond using a formula. A coupon bond generally refers to the price of the bond. To calculate the coupon bond, we need to use the formula below. Coupon Bond = C* [1- (1+Y/n)^-n*t/Y]+ [F/ (1+Y/n)n*t] Here, C = Annual Coupon Payment Y = Yield to Maturity F = Par Value at Maturity › ask › answersExcel Discount Rate Formula: Calculation and Examples May 20, 2022 · Learn how to calculate the discount rate in Microsoft Excel and what the discount factor is. Discover how the discount rate and discount factor compare. Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following: Excel formula: Bond valuation example | Exceljet The PV function is configured as follows: =- PV( C6 / C8, C7 * C8, C5 / C8 * C4, C4) The arguments provided to PV are as follows: rate - C6/C8 = 8%/2 = 4% nper - C7*C8 = 3*2 = 6 pmt - C5/C8*C4 = 7%/2*1000 = 35 fv - 1000 The PV function returns -973.79.

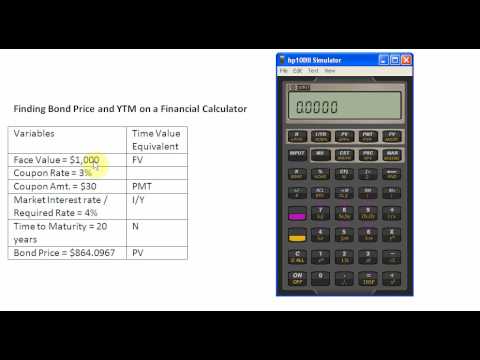

Coupon Rate Formula | Step by Step Calculation (with Examples) Total annual coupon payment = Periodic payment * No. of payments in a year Finally, the coupon rate is calculated by dividing the total annual coupon payment by the par value of the bond and multiplied by 100%, as shown above. Examples You can download this Coupon Rate Formula Excel Template here - Coupon Rate Formula Excel Template Example #1 Bootstrapping | How to Construct a Zero Coupon Yield Curve in Excel? Zero-Coupon Rate for 2 Years = 4.25%. Hence, the zero-coupon discount rate to be used for the 2-year bond will be 4.25%. Conclusion. The bootstrap examples give an insight into how zero rates are calculated for the pricing of bonds and other financial products. One must correctly look at the market conventions for proper calculation of the zero ... Bonds Calculate Coupon Rate - YouTube how to calculate coupon rate on a bondexamples using excel and financial calculator How to calculate bond price in Excel? - ExtendOffice Select the cell you will place the calculated result at, type the formula =PV (B11,B12, (B10*B13),B10), and press the Enter key. See screenshot: Note: In above formula, B11 is the interest rate, B12 is the maturity year, B10 is the face value, B10*B13 is the coupon you will get every year, and you can change them as you need.

Coupon Rate Template - Free Excel Template Download Coupon Rate Formula. The formula for calculating the coupon rate is as follows: Where: C = Coupon rate. I = Annualized interest. P = Par value, or principal amount, of the bond. More Free Templates. For more resources, check out our business templates library to download numerous free Excel modeling, PowerPoint presentation, and Word document templates.

Coupon Bond Formula | Examples with Excel Template Coupon Bond = ∑ [ (C/n) / (1+Y/n)i] + [ F/ (1+Y/n)n*t] or. Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] where, C = Annual Coupon Payment, F = Par Value at Maturity, Y = Yield to Maturity, n = Number of Payments Per Year. t = Number of Years Until Maturity.

Zero-Coupon Bond: Formula and Excel Calculator If we input the provided figures into the present value (PV) formula, we get the following: Present Value (PV) = $1,000 / (1 + 3.0% / 2) ^ (10 * 2) PV = $742.47. The price of this zero-coupon is $742.47, which is the estimated maximum amount that you can pay for the bond and still meet your required rate of return.

How to Calculate Commissions in Excel with VLOOKUP The job of the VLOOKUP is to find the rep's sales amount in the rate table, and return the corresponding payout rate. For this example our commissions plan looks like the following: Rep sells $0-$50,000, they earn 5%. Rep sells $51,000-$100,000, they earn 7%. Rep sells $100,001-$150,000, they earn 10%.

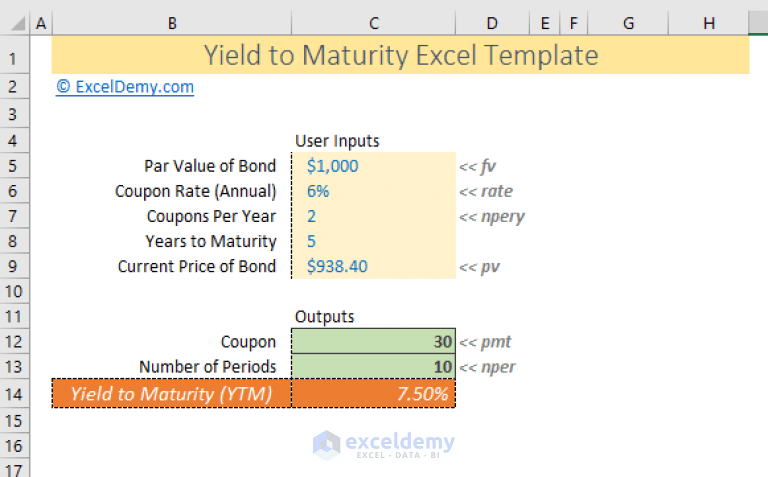

› ask › answersLearn to Calculate Yield to Maturity in MS Excel Mar 21, 2022 · Suppose the coupon rate on a $100 bond is 5%, meaning the bond pays $5 per year, and the required rate—given the risk of the bond—is 5%. Because these two figures are identical, the bond will ...

Calculator Excel Ytm Search: Ytm Calculator Excel. All you need are the amount of principal invested, the interest rate per year, and the rates of daily, monthly, or quarterly compounding when the initial Discount the scheduled bond payments at the rating-adjusted yield-to-maturity 50% Formula =Yield (a2,a3,a4,a5,a6,a7,a8) Calculate the yield on a bond purchased on 2/15/18 that matures on 11/15/26, has a coupon (5 ...

Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time!

How to calculate Spot Rates, Forward Rates & YTM in EXCEL f 0,1 = 11.67% f 1,2 = 12.33% f 2,3 = 12.55% f 3,4 = 12.89% f 4,5 = 13.00% The 5-year spot rate, s 5, will be: [ (1+11.67%)× (1+12.33%)× (1+12.55%)× (1+12.89%)× (1+13.00%)] 1/5 -1 = 12.49% You may calculate this in EXCEL in the following manner: Alternatively you may first calculate accumulation factors, 1+f, for each forward rate as follows:

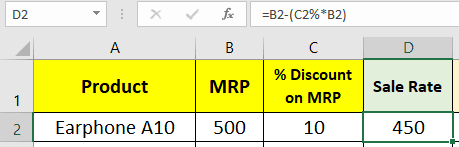

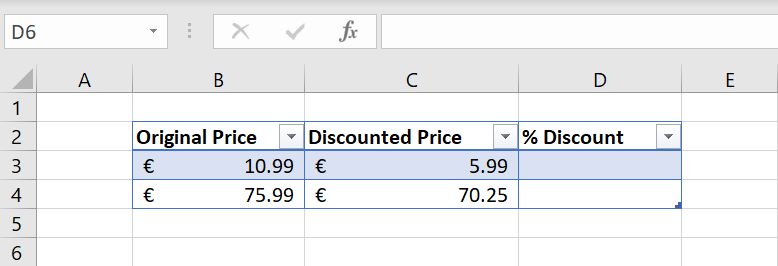

How to Calculate Discount in Excel: Examples and Formulas The steps to calculate the discount percentage in excel can be explained in detail as follows: Type the equal sign ( = ) in the cell where you want to put the discount percentage Type an open bracket sign then input the original price or the cell coordinate where the number is. Then, type a minus sign ( - )

How to calculate yield to maturity in Excel (Free Excel Template) RATE (nper, pmt, pv, [fv], [type], [guess]) Here, Nper = Total number of periods of the bond maturity. The years to maturity of the bond is 5 years. But coupons per year are 2. So, nper is 5 x 2 = 10. Pmt = The payment made in every period. It cannot change over the life of the bond. The coupon rate is 6%.

› ask › answersCalculate a Forward Rate in Excel - Investopedia Jun 25, 2019 · You need to have the zero-coupon yield curve information to calculate forward rates, even in Microsoft Excel. ... interest rate for the first year and the interest rate for the second year. Thus ...

› documents › excelHow to calculate discount rate or price in Excel? - ExtendOffice Calculate discount rate with formula in Excel. The following formula is to calculate the discount rate. 1. Type the original prices and sales prices into a worksheet ...

sjbek.ndc24.pl rate. t = Number of years. n = Number of compounding periods of a discount rate per year. Estimating the zero coupon rate or zero rates using the bootstrap approach and with excel

How to use the Excel COUPNCD function | Exceljet Syntax =COUPNCD (settlement, maturity, frequency, [basis]) Arguments settlement - Settlement date of the security. maturity - Maturity date of the security. frequency - Coupon payments per year (annual = 1, semi-annual = 2, quarterly = 4). basis - [optional] Day count basis (see below, default =0). Version Excel 2003 Usage notes

What Is Coupon Rate and How Do You Calculate It? A bond's coupon price could be calculated by dividing the sum of the safety's annual coupon payments and dividing them by the bond's par worth. For instance, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%.

How to calculate discount rate or price in Excel? - ExtendOffice Calculate discount rate with formula in Excel The following formula is to calculate the discount rate. 1. Type the original prices and sales prices into a worksheet as shown as below screenshot: 2.

Post a Comment for "45 calculate coupon rate in excel"