41 yield to maturity for zero coupon bond

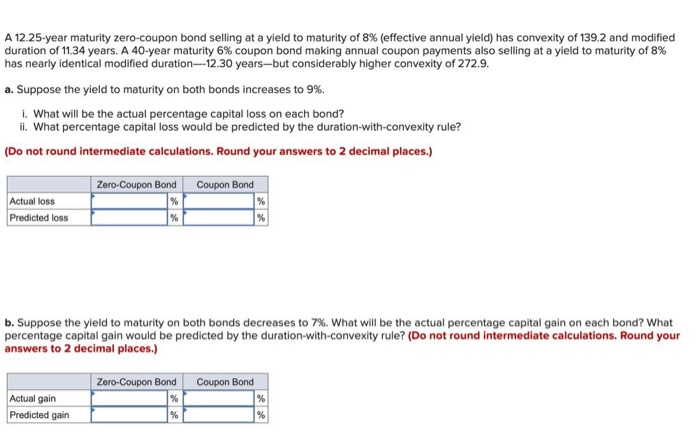

dqydj.com › bond-yield-to-maturity-calculatorBond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward: What Is a Zero Coupon Yield Curve? - Smart Capital Mind The price of a bond at any particular time depends on the market conditions, including the expectations of the market in respect of the future movements in interest rates. The zero coupon rate is the return, or yield, on a bond corresponding to a single cash payment at a particular time in the future. This would represent the return on an investment in a zero coupon bond with a particular time to maturity.

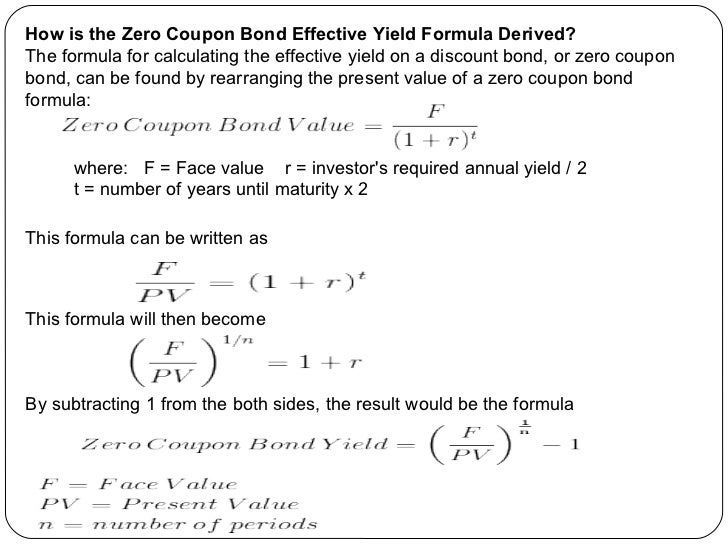

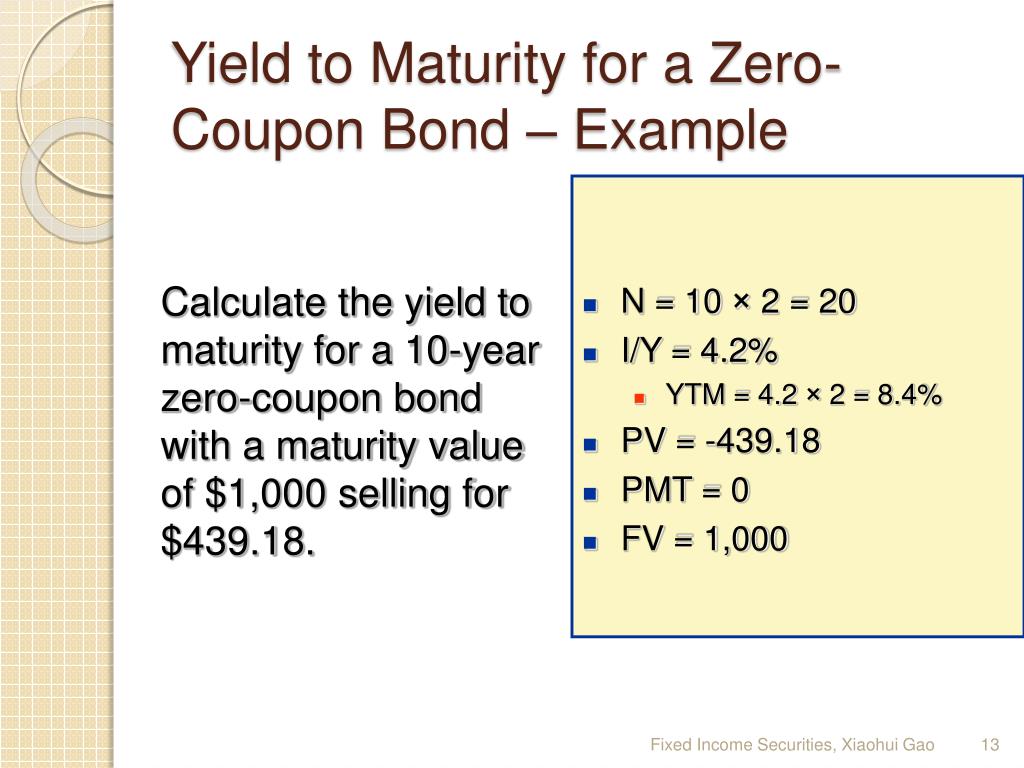

How to Calculate Yield to Maturity of a Zero-Coupon Bond The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a...

Yield to maturity for zero coupon bond

India Government Bonds - Yields Curve The India 10Y Government Bond has a 7.438% yield.. 10 Years vs 2 Years bond spread is 102.7 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 4.90% (last modification in June 2022).. The India credit rating is BBB-, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 107.14 and implied probability of default is 1.79%. Yield Python Curve Bond Search: Bond Yield Curve Python. 36MM+ / 50: 129 Download Data Save as My Data List 00 years (column 120) In general, short-term bonds carry lower yields to reflect the fact that an investor's money is at less risk a curve trades1, provide market participants return generating and hedging opportunities a curve trades1, provide market participants return generating and hedging opportunities. US Treasury Zero-Coupon Yield Curve - Nasdaq Data Link Refreshed 2 days ago, on 15 Jul 2022 ; Frequency daily; Description These yield curves are an off-the-run Treasury yield curve based on a large set of outstanding Treasury notes and bonds, and are based on a continuous compounding convention. Values are daily estimates of the yield curve from 1961 for the entire maturity range spanned by outstanding Treasury securities.

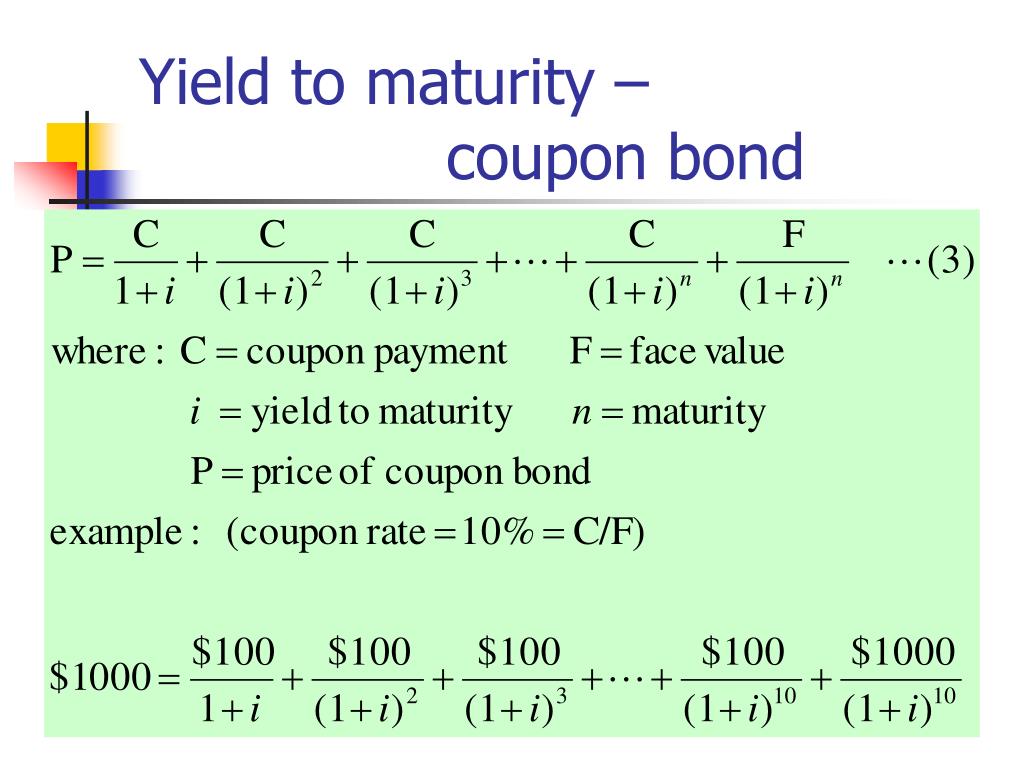

Yield to maturity for zero coupon bond. › Zero-Coupon-BondZero Coupon Bond Yield - Formula (with Calculator) The zero coupon bond effective yield formula is used to calculate the periodic return for a zero coupon bond, or sometimes referred to as a discount bond. A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value. For example, an investor purchases one of these bonds at $500, which has a face value at maturity of $1,000. Effective Yield - Overview, Formula, Example, and Bond Equivalent Yield In other words, the bond equivalent yield does not take coupon payments into account. It is used to calculate the investment return on a zero-coupon bond, one that does not offer coupon payments other than the interest earned at the time the bond reaches maturity and is redeemed by the issuer. Basics Of Bonds - Maturity, Coupons And Yield Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). Learn to Calculate Yield to Maturity in MS Excel - Investopedia In this case, the bond would trade at a premium amount of $111.61. The current price of $111.61 is higher than the $100 you will receive at maturity, and that $11.61 represents the difference in...

Why s the realized compound yield to maturity and yield to... ask 5 Why s the realized compound yield to maturity and yield to maturity of zero coupon bond always the same? The buyer of a certain machine may pay either P50k cash down payment & P10k each for the next 6 years, or pay P75k cash & P10k each for the next 6 years, starting next year. Estimate yield of coupon bond given yield of zero coupon bond The yield on a discount (zero-coupon) bond maturing in 2010 should be higher than that of a coupon bond maturing in 2010 under the stated circumstances. This is because some of the cash flow of the coupon bond will be realized earlier than that of the discount bond, and as shown in the table below, the yield curve, as far as these two bonds are ... Zero-Coupon Bond Definition - Investopedia May 31, 2022 · Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the IRS Tax Zero-Coupon Bonds? Imputed interest, sometimes referred to as "phantom... How do I Calculate Zero Coupon Bond Yield? (with picture) The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check.

United Kingdom Government Bonds - Yields Curve Maturity Yield Spread vs Bond Spread vs Central Bank Rate (1.25%) 3 months 1 year 2 years 5 years 10 years; 30 years: 2.638%: 97.6 bp ... The highlighted column refers to the zero coupon bond. Click on for a forecast of the yield. If data are not all visible, swipe table left. Residual Maturity Yield Bond Price - with different Coupon Rates Fx ... Realized Compound Yield versus Yield to Maturity - Rate Return We have noted that yield to maturity will equal the rate of return realized over the life of the bond if all coupons are reinvested at an interest rate equal to the bond's yield to maturity. Consider, for example, a two-year bond selling at par value paying a 10% coupon once a year. The yield to maturity is 10%. The stated yield to maturity and realized compound yield to... get 5 1013 Answers Solution:- 1)The stated yield to maturity and realized compound yield to maturity of a (default-free) zero-coupon bond will always be equal. Why? Answer:- Becausecurrent price of bond is computedusing the face value of bond, life of bond & market yield.A zero coupon bond is one that does not have acoupon attached to it. Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is an estimated rate of return. It assumes that the buyer of the bond will hold it until its maturity date, and will reinvest each interest payment at the same interest...

Yield to Maturity and Default Risk - Do Financial Blog The first is a zero-coupon bond that pays $1,000 at maturity. The second has an 8% coupon rate and pays the $80 coupon once per year. ... Take as an example the 8% coupon bond with a yield to maturity of 10% per year (5% per half year). Its price is $810.71, and therefore its current yield is 80/810.71 = .0987, or 9.87%, which is higher than ...

How do you construct a zero coupon curve from the current market yield ... The yields at a tenor of 0.5 years calculated above is a zero-coupon rate and your starting point for bootstrapping the zero-coupon curve. We then use bootstrapping to construct the zero/spot curve. We use the interpolated yield for each tenor as the ANNUAL COUPON which defines the cash flows before maturity.

Calculating the Effective Yield of a Zero-Coupon Bond To calculate the return for a zero-coupon bond, the following zero-coupon bond effective yield formula is applied: [ {F/PV}]^ (1/t) =1+r Where F -face value of the bond PV- current value of the bond t -time to maturity r- Interest rate For example, an investor purchases a zero-coupon bond at $ 200, which has a face value at maturity of $400.

Quant Bonds - Zero Coupon - BetterSolutions.com The yield of a zero coupon bond can be calculated using the following formula. r = (par value / price ) (1/n) - 1. Remember that the number of periods used in the formula is double the number of years Doubling this value will give you the yield to maturity. Example. What is the yield of a zero coupon bond that matures in 15 years. r = (1000 / ...

Yield to Maturity (YTM) - Overview, Formula, and Importance Yield to Maturity (YTM) - otherwise referred to as redemption or book yield - is the speculative rate of return or interest rate of a fixed-rate security, such as a bond. The YTM is based on the belief or understanding that an investor purchases the security at the current market price and holds it until the security has matured (reached its full value), and that all interest and coupon payments are made in a timely fashion.

› knowledge › zero-coupon-bondZero-Coupon Bond: Formula and Excel Calculator To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula. Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) – 1; Zero-Coupon Bond Risks

Zero-Coupon Bond - Definition, How It Works, Formula Example of a Zero-Coupon Bonds Example 1: Annual Compounding. John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? 5 = $783.53. The price that John will pay for the bond today is $783.53.

Mauritius Government Bonds - Yields Curve Maturity Yield Spread vs Bond Spread vs Central Bank Rate (2.25%) 1 year 2 years 5 years; 10 years: 4.084%: 285.6 bp. 341.4 bp. 127.3 bp ... The highlighted column refers to the zero coupon bond. Click on for a forecast of the yield. If data are not all visible, swipe table left. Residual Maturity Yield Bond Price - with different Coupon Rates ...

Quant Bonds - Yield - BetterSolutions.com If the price of a bond paying a 4% coupon is £95 (trading at a discount), then the flat yield is 4/95 = 4.21%. If the price of a bond paying a 4% coupon is £105 (trading at a premium), then the flat yield is 4/105 = 3.80%. If the price of a $1,000 par value, 5% coupon is selling for $800 then the flat yield is: (1000*5%)/800.

How to calculate yield to maturity in Excel (Free Excel Template) Nper = Total number of periods of the bond maturity. The years to maturity of the bond is 5 years. But coupons per year are 2. So, nper is 5 x 2 = 10. Pmt = The payment made in every period. It cannot change over the life of the bond. The coupon rate is 6%. But as payment is done twice a year, the coupon rate for a period will be 6%/2 = 3%.

Current Yield vs. Yield to Maturity: What's the Difference? That's why the yield to maturity is only 2.99%. In contrast, the XYZ 3.15% bond's current market price is $980, a discount to the $1,000 face value. Its current yield of 3.2% and its yield to maturity of 3.48% are higher than its coupon rate because of the discount.

Consider the following $1,000 par value zero-coupon bonds:$ | Quizlet a. Bond A is a 6% coupon, 20-year maturity bond selling at par value. Bond B is a 6% coupon, 20-year maturity bond selling below par value. b. Bond A is a 20-year, noncallable coupon bond with a coupon rate of 6%, selling at par. Bond B is a 20-year, callable bond with a coupon rate of 7%, also selling at par.

Yield to Maturity - YTM vs. Spot Rate. What's the Difference? Spot Rate= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 The formula for the spot rate given above only applies to zero-coupon bonds. Consider a $1,000 zero-coupon bond that has two...

US Treasury Zero-Coupon Yield Curve - Nasdaq Data Link Refreshed 2 days ago, on 15 Jul 2022 ; Frequency daily; Description These yield curves are an off-the-run Treasury yield curve based on a large set of outstanding Treasury notes and bonds, and are based on a continuous compounding convention. Values are daily estimates of the yield curve from 1961 for the entire maturity range spanned by outstanding Treasury securities.

Yield Python Curve Bond Search: Bond Yield Curve Python. 36MM+ / 50: 129 Download Data Save as My Data List 00 years (column 120) In general, short-term bonds carry lower yields to reflect the fact that an investor's money is at less risk a curve trades1, provide market participants return generating and hedging opportunities a curve trades1, provide market participants return generating and hedging opportunities.

:max_bytes(150000):strip_icc()/dotdash_INV_final_Discount_Yield_Jan_2021-01-fc704294a32348a7bc00e0fc7652b88e.jpg)

![[最も人気のある!] yield to maturity formula zero coupon bond 161022-Yield to ...](https://d2vlcm61l7u1fs.cloudfront.net/media/a6d/a6d9a045-4c4d-413c-a5a5-6b37b2d46e5a/phpSMkGD9.png)

Post a Comment for "41 yield to maturity for zero coupon bond"